Australia’s Q1 CPI inflation was slightly above market expectations in both headline and underlying terms.

Trimmed mean inflation of +0.7% q/q was in line with the RBA’s February SMP forecast and at +0.68% q/q in unrounded terms was just 0.01ppts away from our nowcast.

Global trade ructions had already cemented a 25bp RBA cash rate cut on 20 May in our and the market’s view. Today’s data do not dissuade from that view.

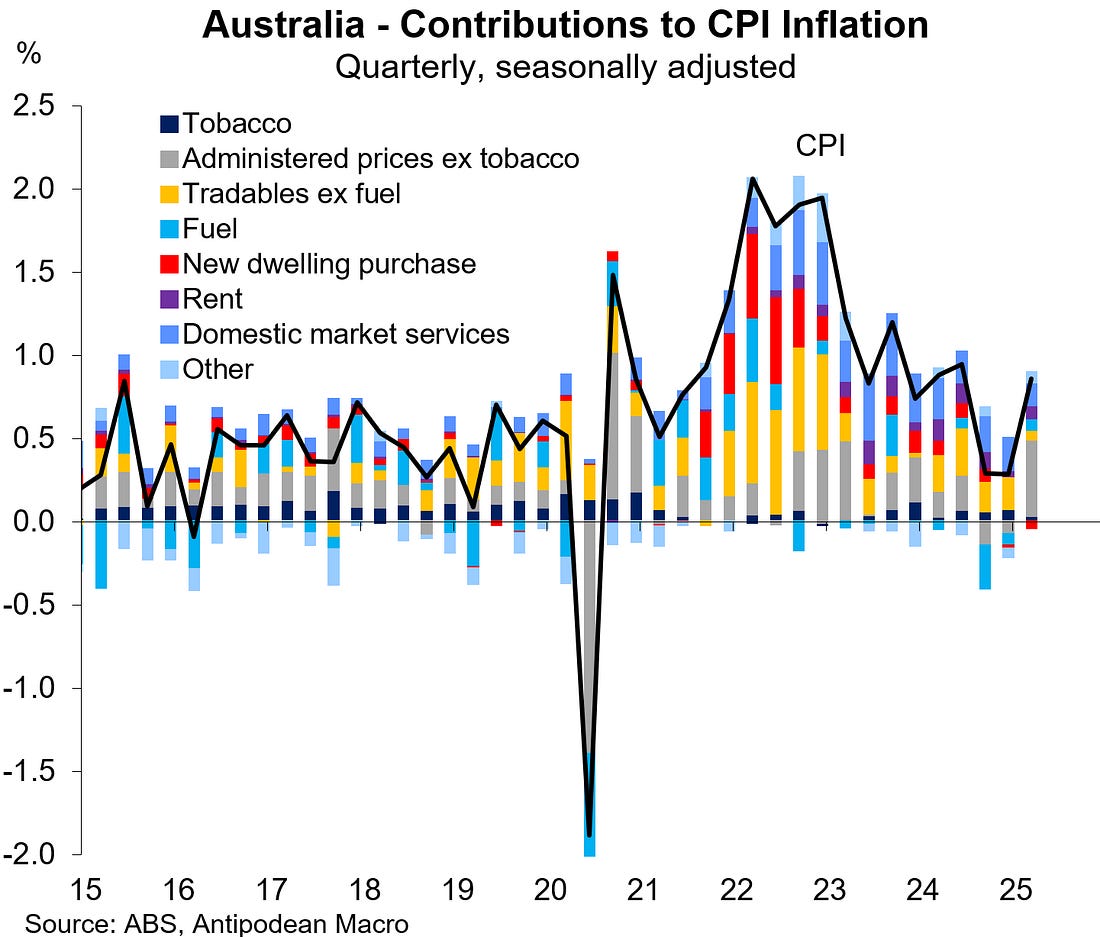

1. Australia’s Q1 headline CPI inflation was slightly above ourand consensus expectations at +0.9% q/q and +2.4% y/y.

The seasonally adjusted CPI rose +0.9% q/q, in line with our nowcast.

Higher electricity prices (+16.3% q/q) contributed +0.3ppts to quarterly headline inflation in Q1 – a bit more than we expected and accounting for most of the upside surprise to our nowcast.

Excluding government rebates, electricity prices would have risen just +0.4% q/q.